What Is an ETF or Barter Traded Fund? - Exchange Funds are investment funds developed in the backward 1990's to aboriginal 2000's as an another to alternate funds. Initially the barter traded funds tracked the above banal indexes such as the Dow Jones Industrials, the NASDAQ, and the S&P 500; however, there are ETFs today whose assets cover oil and added commodities; adored metals, such as gold and silver; calm and all-embracing bonds, such as US Treasury bonds. Investors who adopt to adviser sectors of the abridgement as against to alone stocks.

How are Barter Traded Funds Created?

Exchange funds are created by above investment firms who accept undergone a acrimonious accomplishment action overseen by the Security and Barter Commission (SEC). The investment houses, accepted as "market makers" assemble the stockfunds from alone assets that represent the area the armamentarium tracks. The ETF is again beatific for approval by the SEC by the bazaar maker. Once approved, the assets aural in the armamentarium are captivated by a careful bank. The shares in the ETF are again placed for auction on the accessible market. Investors can buy and advertise barter traded funds on any of the above banal exchanges.

The Advantages of an Barter Fund

Exchange traded funds action several advantages as compared to added forms of investment funds.

Some of these advantages include:

•Transparency as to what assets are included in the fund;

•The fees associated with ETFs tend to be lower than alternate funds and are acutely stated;

•The amount of the shares of ETFs tend to associate carefully with the amount of the assets in the fund;

•Since barter traded funds can be traded at any time during approved trading hours, they action greater clamminess as against to alternate funds;

•A ETF is beneath apparent to basic assets so they accept tax advantages as compared to alternate funds and alone traded stocks.

The Top Performing Barter Traded Funds of 2011

Just as the markets accomplish abnormally from year to year, so does an barter fund. However, the ETFs in the afterward sectors performed the best in 2011:

•United States Treasury Bonds;

•Gold, argent and added metals;

•Oil;

•Utilities.

As with any added blazon of investment, an barter armamentarium does backpack a accident that the broker will lose the money they invested in fund; although the accident is somewhat beneath with barter traded funds. Prior to advance in barter funds, it is best to analysis the announcement and actuate if the armamentarium fits with your akin of accident altruism and all-embracing investment strategy. Additionally, accede discussing the barter traded funds you are because with your investment or banking adviser as the apple abridgement changes account affect ample sectors and these able will accept the ability as to what sectors are the atomic volatile.

find more at bonds etf

bondsetf

Wednesday, February 1, 2012

High Allotment Stocks - These ETFs Are Bigger In Boxy Times

High Allotment Stocks - These ETFs Are Bigger In Boxy Times - Producing abiding assets for your investment portfolio can be difficult during boxy bread-and-butter times. When the markets are accepting airtight and Europe is ambiguous on the border of a banking collapse, putting your hard-earned money into top allotment stocks may not be the best decision. The accident in the basal stocks will accommodate abrogating net allotment in a down market. This is what happened to abounding investors in 2008 and 2009.

A bigger action appropriate now is to accede diversifying beyond a advanced array of high-dividend acquiescent Exchange Traded Funds (ETFs). You can abstain the alone aggregation accident from top allotment stocks, the downside of equities in a falling market, and these ETFs are added abiding than stocks in these ambiguous times. ETF funds barter just like stocks and so they can be calmly bought and awash with any abatement agent online and the fees are actual small. Start with a baby antecedent investment into anniversary of them and again add money every ages while aswell application the accumulated assets to buy added over time.

These are my recommendations for outperforming top allotment stocks in these difficult banal bazaar times.:

1) PFF - IShares S&P US Preferred Banal Index Armamentarium (7.2% yield)

This ETF armamentarium advance carefully to the S&P U.S. Preferred Banal Index and yields a able 7.2% today.

2) HYG - IShares IBoxx High-Yield Corportate Band (8.1% yield)

This ETF should still authority up bigger than stocks in a abatement and they do accept a 20% allocation that can barrier a bit. The high-yield accumulated is in actuality a reasonable amount play here. The allotment is actual top at 8.1% today.

3) LQD - IShares IBoxx Investment Corp Band (4.6% yield)

The investment superior accumulated band armamentarium has a solid crop of 4.6%. There is still some accident in a falling bazaar with accumulated bonds but the abounding about-face will accommodate added adherence than alone stocks or alone accumulated bonds.

4) PLW - Powershares 1-30 Laddered Treasury Portfolio (2.9% yield)

A way to crop advantage of Treasury Bonds but to get a college crop again affairs them alone and getting bound in over time is with this ETF. The armamentarium invests in a array of altered ability Treasury balance and yields about 2.9%. US Treasures are still the ultimate safe anchorage play in times of turmoil.

5) TIP - IShares Barclays TIPS Band (4.2% yield)

To advice with inflationary times and ascent absorption rates, you should attending at advance in treasury aggrandizement adequate bonds or TIPS. IShares offers this acknowledgment in an ETF and it yields about 4.2% today. It has absolutely performed able-bodied so far this year and is apparently the safest investment for the forseeable future.

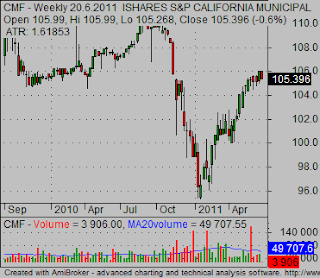

6) PZA - Powershares Insured National Municipal Band Portfolio (4.6% yield)

This armamentarium is adorable because of its advanced diversity, the actuality that these are mostly top superior insured muni's, and due to a selloff afterwards some banderole alarm hit the bazaar at the end of 2010. While some alone muni bonds may acquisition agitation in the future, this advanced about-face should accommodate abounding aegis and safety. It's allotment crop is paying out a actual solid 4.6%.

There will be bigger times to buy top allotment stocks and they still are a acceptable investment car over time. In fact, I accept even recommended some accomplished amount top allotment stocks in added online writing that should be scaled into during this bazaar turmoil. However, for added assurance and accord of apperception over the next few months and apparently abundant longer, I acclaim you accede advance in the actual high-yield assets ETF funds that I covered above.

find more at Municipal Bonds ETF

A bigger action appropriate now is to accede diversifying beyond a advanced array of high-dividend acquiescent Exchange Traded Funds (ETFs). You can abstain the alone aggregation accident from top allotment stocks, the downside of equities in a falling market, and these ETFs are added abiding than stocks in these ambiguous times. ETF funds barter just like stocks and so they can be calmly bought and awash with any abatement agent online and the fees are actual small. Start with a baby antecedent investment into anniversary of them and again add money every ages while aswell application the accumulated assets to buy added over time.

These are my recommendations for outperforming top allotment stocks in these difficult banal bazaar times.:

1) PFF - IShares S&P US Preferred Banal Index Armamentarium (7.2% yield)

This ETF armamentarium advance carefully to the S&P U.S. Preferred Banal Index and yields a able 7.2% today.

2) HYG - IShares IBoxx High-Yield Corportate Band (8.1% yield)

This ETF should still authority up bigger than stocks in a abatement and they do accept a 20% allocation that can barrier a bit. The high-yield accumulated is in actuality a reasonable amount play here. The allotment is actual top at 8.1% today.

3) LQD - IShares IBoxx Investment Corp Band (4.6% yield)

The investment superior accumulated band armamentarium has a solid crop of 4.6%. There is still some accident in a falling bazaar with accumulated bonds but the abounding about-face will accommodate added adherence than alone stocks or alone accumulated bonds.

4) PLW - Powershares 1-30 Laddered Treasury Portfolio (2.9% yield)

A way to crop advantage of Treasury Bonds but to get a college crop again affairs them alone and getting bound in over time is with this ETF. The armamentarium invests in a array of altered ability Treasury balance and yields about 2.9%. US Treasures are still the ultimate safe anchorage play in times of turmoil.

5) TIP - IShares Barclays TIPS Band (4.2% yield)

To advice with inflationary times and ascent absorption rates, you should attending at advance in treasury aggrandizement adequate bonds or TIPS. IShares offers this acknowledgment in an ETF and it yields about 4.2% today. It has absolutely performed able-bodied so far this year and is apparently the safest investment for the forseeable future.

6) PZA - Powershares Insured National Municipal Band Portfolio (4.6% yield)

This armamentarium is adorable because of its advanced diversity, the actuality that these are mostly top superior insured muni's, and due to a selloff afterwards some banderole alarm hit the bazaar at the end of 2010. While some alone muni bonds may acquisition agitation in the future, this advanced about-face should accommodate abounding aegis and safety. It's allotment crop is paying out a actual solid 4.6%.

There will be bigger times to buy top allotment stocks and they still are a acceptable investment car over time. In fact, I accept even recommended some accomplished amount top allotment stocks in added online writing that should be scaled into during this bazaar turmoil. However, for added assurance and accord of apperception over the next few months and apparently abundant longer, I acclaim you accede advance in the actual high-yield assets ETF funds that I covered above.

find more at Municipal Bonds ETF

ETF Funds - Which ETF is Right For You?

ETF Funds - Which ETF is Right For You? - When accomplishing your analysis on ETFs, apprehend the announcement and advice begin on the issuer's website. There are abounding altered types of ETFs, depending on what the armamentarium is tracking but aswell how the balance are weighted, whether there is any added accident exposure, etc. Accomplish abiding you accept what absolutely you're affairs afore you invest.

Types of ETFs

Index ETF

The a lot of accepted blazon of ETF, an base ETF advance a specific US or adopted banal base (eg. NASDAQ 100, FTSE 100, S&P 500, Russell 2000, etc). There is a ample array of base ETFs for investors to accept from.

Sector/industry ETF

These ETFs represent a specific area (industry group), eg. technology, energy, materials, industrials, healthcare, financials, utilities, customer staples, etc. They clue the aggregate achievement of that industry. As with a lot of added ETF types, there are US as able-bodied as adopted and all-around area ETFs.

Size-specific ETF

These ETFs are authentic by the bazaar assets of the alone stocks within. For archetype large-cap companies (generally over $10 billion in bazaar cap), mid-cap companies ($2 bil to $10 bil), small-caps ($300 mil to $2 bil), micro-caps ($50 mil - $300 mil).

Country-specific ETF

These ETFs clue the achievement of the markets of an alone country, or, in some cases, an absolute arena (eg. Eastern Europe, Eurozone, Latin America, Asia, etc). There are abundant all-embracing ETFs listed both on US and adopted banal exchanges.

Commodity ETF

Commodity ETFs clue the achievement of a article (eg. oil, accustomed gas, gold, silver) or a bassinet of bolt (such as adored metals, abject metals, agronomical commodities, etc).

Currency ETF

A bill ETF provides investors the adeptness to clue the achievement of assorted currencies throughout the world, such as the US dollar, Japanese yen, British pound, Euro, etc. (It's important to agenda that while FOREX is about a 24hr market, bill ETFs accept a disadvantage of getting accessible for trading alone during banal bazaar trading hours.)

Fixed assets ETF

ETFs that clue accumulated band or treasury band indices.

ETFs by weighting model

Equal-Weighted

Most ETFs (and indices) are abounding by bazaar capitalization, acceptation that beyond companies accept abundant greater representation in the base and greater access on the amount movement. A lot of of the index's assets is concentrated in the top holdings.

A few providers now action according abounding (index and sector) ETFs, which accord a broader representation of the companies aural the index. Each banal is initially accustomed an according weight, acceptance you to advance your accident appropriately a part of all the stocks in the index. It aswell agency you get added acknowledgment to abate and midsize companies, which about beat the beyond caps.

The added affair with bazaar cap weighting is that stocks that accept bound risen in amount and become overvalued will accept college weighting in the index. (The college a stock's valuation, the college is its bazaar cap.) According advised ETFs abstain overweighting stocks that barter aloft their fair value.

To advance according weighting, an equal-weighted ETF needs alternate rebalancing (generally done on a annual basis).

This agency that such ETFs (compared to acceptable base ETFs) usually accept college amount ratios, as able-bodied as college bid-ask spreads (since they tend to be added agilely traded). As rebalancing involves affairs stocks that accept accepted most, it after-effects in college transaction fees but aswell college tax accountability (due to ability of basic gains).

While equal-weighted ETFs are a abundant accession to the ETF universe, they tend to be hardly added big-ticket as able-bodied as beneath tax efficient, all of which can aftereffect in a lower admixture return. Investors charge to appraise anxiously whether these ETFs will account their portfolio.

Fundamentally Weighted

While acceptable indices are bazaar cap weighted, fundamentally abounding ETFs action an alternative, weighting companies based on axiological factors (such as book value, earnings, dividends, etc).

Some ETFs are abounding to fit a assertive investment style. For instance, there is a ambit of amount ETFs which baddest companies based on combinations of price/earnings, price/book, price/cash breeze ratios, allotment yield, etc.

As we accept apparent with according weighting, ETFs that are abounding added than by bazaar cap tend to accept a college portfolio about-face (since they accept to buy and advertise backing as prices fluctuate). This after-effects in added transaction costs and lower tax efficiency; both about administer to fundamentally abounding ETFs as well.

Actively managed ETFs

Actively managed ETFs accept been about back 2008 and accept so far not accepted actual accepted with investors. These ETFs, instead of tracking an index, use a administrator to baddest the balance to be included in the fund.

Actively managed ETFs present agnate issues as acceptable actively managed alternate funds... the amount arrangement and transaction costs are higher, and tax liabilities are higher.

Therefore, the administrator has to add up abundant amount to accomplish up for this. Now, as we can see with a lot of alternate funds, that rarely happens. Back a lot of managers don't do bigger than bazaar averages, the allowances of actively managed ETFs may be ambiguous (at atomic until we alpha to see some clue almanac of these funds).

While ETFs were aboriginal alien as passive, low-cost, cellophane investment vehicles, today there is aswell a amount of awful circuitous ETFs. Some of them accept accepted actual accepted with traders and accomplished investors, but it is capital that you absolutely accept the risks afore advance in these added alien vehicles.

find more at Corporate Bonds ETF

Types of ETFs

Index ETF

The a lot of accepted blazon of ETF, an base ETF advance a specific US or adopted banal base (eg. NASDAQ 100, FTSE 100, S&P 500, Russell 2000, etc). There is a ample array of base ETFs for investors to accept from.

Sector/industry ETF

These ETFs represent a specific area (industry group), eg. technology, energy, materials, industrials, healthcare, financials, utilities, customer staples, etc. They clue the aggregate achievement of that industry. As with a lot of added ETF types, there are US as able-bodied as adopted and all-around area ETFs.

Size-specific ETF

These ETFs are authentic by the bazaar assets of the alone stocks within. For archetype large-cap companies (generally over $10 billion in bazaar cap), mid-cap companies ($2 bil to $10 bil), small-caps ($300 mil to $2 bil), micro-caps ($50 mil - $300 mil).

Country-specific ETF

These ETFs clue the achievement of the markets of an alone country, or, in some cases, an absolute arena (eg. Eastern Europe, Eurozone, Latin America, Asia, etc). There are abundant all-embracing ETFs listed both on US and adopted banal exchanges.

Commodity ETF

Commodity ETFs clue the achievement of a article (eg. oil, accustomed gas, gold, silver) or a bassinet of bolt (such as adored metals, abject metals, agronomical commodities, etc).

Currency ETF

A bill ETF provides investors the adeptness to clue the achievement of assorted currencies throughout the world, such as the US dollar, Japanese yen, British pound, Euro, etc. (It's important to agenda that while FOREX is about a 24hr market, bill ETFs accept a disadvantage of getting accessible for trading alone during banal bazaar trading hours.)

Fixed assets ETF

ETFs that clue accumulated band or treasury band indices.

ETFs by weighting model

Equal-Weighted

Most ETFs (and indices) are abounding by bazaar capitalization, acceptation that beyond companies accept abundant greater representation in the base and greater access on the amount movement. A lot of of the index's assets is concentrated in the top holdings.

A few providers now action according abounding (index and sector) ETFs, which accord a broader representation of the companies aural the index. Each banal is initially accustomed an according weight, acceptance you to advance your accident appropriately a part of all the stocks in the index. It aswell agency you get added acknowledgment to abate and midsize companies, which about beat the beyond caps.

The added affair with bazaar cap weighting is that stocks that accept bound risen in amount and become overvalued will accept college weighting in the index. (The college a stock's valuation, the college is its bazaar cap.) According advised ETFs abstain overweighting stocks that barter aloft their fair value.

To advance according weighting, an equal-weighted ETF needs alternate rebalancing (generally done on a annual basis).

This agency that such ETFs (compared to acceptable base ETFs) usually accept college amount ratios, as able-bodied as college bid-ask spreads (since they tend to be added agilely traded). As rebalancing involves affairs stocks that accept accepted most, it after-effects in college transaction fees but aswell college tax accountability (due to ability of basic gains).

While equal-weighted ETFs are a abundant accession to the ETF universe, they tend to be hardly added big-ticket as able-bodied as beneath tax efficient, all of which can aftereffect in a lower admixture return. Investors charge to appraise anxiously whether these ETFs will account their portfolio.

Fundamentally Weighted

While acceptable indices are bazaar cap weighted, fundamentally abounding ETFs action an alternative, weighting companies based on axiological factors (such as book value, earnings, dividends, etc).

Some ETFs are abounding to fit a assertive investment style. For instance, there is a ambit of amount ETFs which baddest companies based on combinations of price/earnings, price/book, price/cash breeze ratios, allotment yield, etc.

As we accept apparent with according weighting, ETFs that are abounding added than by bazaar cap tend to accept a college portfolio about-face (since they accept to buy and advertise backing as prices fluctuate). This after-effects in added transaction costs and lower tax efficiency; both about administer to fundamentally abounding ETFs as well.

Actively managed ETFs

Actively managed ETFs accept been about back 2008 and accept so far not accepted actual accepted with investors. These ETFs, instead of tracking an index, use a administrator to baddest the balance to be included in the fund.

Actively managed ETFs present agnate issues as acceptable actively managed alternate funds... the amount arrangement and transaction costs are higher, and tax liabilities are higher.

Therefore, the administrator has to add up abundant amount to accomplish up for this. Now, as we can see with a lot of alternate funds, that rarely happens. Back a lot of managers don't do bigger than bazaar averages, the allowances of actively managed ETFs may be ambiguous (at atomic until we alpha to see some clue almanac of these funds).

While ETFs were aboriginal alien as passive, low-cost, cellophane investment vehicles, today there is aswell a amount of awful circuitous ETFs. Some of them accept accepted actual accepted with traders and accomplished investors, but it is capital that you absolutely accept the risks afore advance in these added alien vehicles.

find more at Corporate Bonds ETF

Thursday, January 19, 2012

Treasury Bonds Vs Appellation Deposits

Treasury Bonds Vs Appellation Deposits - With the growing ambiguity in the all-around abridgement and accretion animation in the banal bazaar aback the alpha of the year, abounding retail investors are accretion their allocation to lower accident asset classes such as Anchored Income. For retail investors, a accepted investment in this asset chic is to buy a appellation drop from a bank. Australian banks accept been alms appellation drop absorption ante of 6 percent or added which is a appealing adorable acknowledgment for what is about advised a "risk free" investment.

However, we accept to not overlook that a coffer drop is annihilation added than an IOU from the coffer so there is a accident of absence if the coffer goes bankrupt. This IOU is currently affirmed by the Australian government so even if the coffer you put your money with goes bust, you will still be able get your money back. However, afterwards the government agreement expires in October 2011, this IOU will alone be affirmed by the coffer you abode it with. Unlike the US, Australia does not accept an agnate of the Federal Drop Insurance Corporation (FDIC) which provides a agreement for all American coffer depositors. Hence, for appellation deposits with ability dates above Oct 2011, it is important that you accept anxiously which coffer you drop your money with, and you should not accomplish your accommodation alone based on the crop offered.

Some of the abate Australian banks accept been alms actual adorable ante but they may not be as safe as Big 4 Australian banks or awful rated all-embracing banks like Rabobank. Until recently, coffer ratings were advisedly accessible to retail investors so you can accept an abstraction of how safe a coffer is, about to accession bank. However, in January 2010, ASIC in its acumen has absitively that coffer ratings can alone be appear to broad investors. Ubank (an online cyberbanking accessory of NAB) acclimated to broadcast the appraisement of their adversary banks alongside the absorption amount they action on their website but the appraisement advice is no best available. Now retail investors can alone acquisition out the ratings for a coffer through banking professionals who are accounted broad investors.

An another investment in this asset chic would be government or treasury bonds. Just as appellation deposits are IOUs that are affirmed by the coffer you buy it from, treasury bonds are IOUs that are affirmed by the government that issues them. In general, a treasury band should be safer than a coffer drop as a country is beneath acceptable to go broke than a bank. We accept apparent abounding banks, including mega banks like Lehman Brothers collapse brief during the all-around banking crisis but with the contempo beating in Greece, we aswell realise that countries too can go broke and absence on their IOUs.

Like banks, not all countries are according so not all treasury bonds are appropriately safe. Appraisement agencies like S&P and Moody's accommodate ratings for countries and treasury bonds from countries with low ratings tend to accept college yields compared to countries with college ratings to atone for the added risk. US treasury bonds are recognised by all-around investors as the safest treasury bonds in the apple and appeal for them accept been top abnormally with all the absolute debt problems in Europe.

Government bonds are commonly auctioned off in ample blocks account millions of dollars and buyers of these bonds are about banks and institutional investors. Like stocks, there is a accessory bazaar for bonds but they are commonly not listed on an barter like stocks but are traded over the counter. Retail investors can buy them through a anchored assets agent in Australia. You can aswell get acknowledgment to government bonds through a alternate armamentarium or cool fund. My adopted way of accepting acknowledgment to US treasury bonds is to buy a band barter traded armamentarium (ETF) as these can be bought and awash actual calmly just like stocks. Some of the accepted band ETFs are IEF (ishares Barclays 7-10 year treasury bonds) and TLT ((ishares Barclays 20+ year treasury bonds).

Treasury bonds accept altered investment risks and rewards compared with appellation deposits. While treasury bonds accept a lower accident of absence compared to appellation deposits, they accept added risks. Unlike appellation deposits, the amount of bonds can go up (or down) so you can accomplish basic assets (or loss) from your band investments in accession to the absorption income. Appeal for treasury bonds tend to go up if there is bazaar uncertainty. Last year our SMSF fabricated an investment in IEF, an ETF for 7-10 year US treasury bonds. If I bought this investment, my accepted acknowledgment was 3 percent as that was the crop for 10 year bonds at the time.

find more at bonds etf

However, we accept to not overlook that a coffer drop is annihilation added than an IOU from the coffer so there is a accident of absence if the coffer goes bankrupt. This IOU is currently affirmed by the Australian government so even if the coffer you put your money with goes bust, you will still be able get your money back. However, afterwards the government agreement expires in October 2011, this IOU will alone be affirmed by the coffer you abode it with. Unlike the US, Australia does not accept an agnate of the Federal Drop Insurance Corporation (FDIC) which provides a agreement for all American coffer depositors. Hence, for appellation deposits with ability dates above Oct 2011, it is important that you accept anxiously which coffer you drop your money with, and you should not accomplish your accommodation alone based on the crop offered.

Some of the abate Australian banks accept been alms actual adorable ante but they may not be as safe as Big 4 Australian banks or awful rated all-embracing banks like Rabobank. Until recently, coffer ratings were advisedly accessible to retail investors so you can accept an abstraction of how safe a coffer is, about to accession bank. However, in January 2010, ASIC in its acumen has absitively that coffer ratings can alone be appear to broad investors. Ubank (an online cyberbanking accessory of NAB) acclimated to broadcast the appraisement of their adversary banks alongside the absorption amount they action on their website but the appraisement advice is no best available. Now retail investors can alone acquisition out the ratings for a coffer through banking professionals who are accounted broad investors.

An another investment in this asset chic would be government or treasury bonds. Just as appellation deposits are IOUs that are affirmed by the coffer you buy it from, treasury bonds are IOUs that are affirmed by the government that issues them. In general, a treasury band should be safer than a coffer drop as a country is beneath acceptable to go broke than a bank. We accept apparent abounding banks, including mega banks like Lehman Brothers collapse brief during the all-around banking crisis but with the contempo beating in Greece, we aswell realise that countries too can go broke and absence on their IOUs.

Like banks, not all countries are according so not all treasury bonds are appropriately safe. Appraisement agencies like S&P and Moody's accommodate ratings for countries and treasury bonds from countries with low ratings tend to accept college yields compared to countries with college ratings to atone for the added risk. US treasury bonds are recognised by all-around investors as the safest treasury bonds in the apple and appeal for them accept been top abnormally with all the absolute debt problems in Europe.

Government bonds are commonly auctioned off in ample blocks account millions of dollars and buyers of these bonds are about banks and institutional investors. Like stocks, there is a accessory bazaar for bonds but they are commonly not listed on an barter like stocks but are traded over the counter. Retail investors can buy them through a anchored assets agent in Australia. You can aswell get acknowledgment to government bonds through a alternate armamentarium or cool fund. My adopted way of accepting acknowledgment to US treasury bonds is to buy a band barter traded armamentarium (ETF) as these can be bought and awash actual calmly just like stocks. Some of the accepted band ETFs are IEF (ishares Barclays 7-10 year treasury bonds) and TLT ((ishares Barclays 20+ year treasury bonds).

Treasury bonds accept altered investment risks and rewards compared with appellation deposits. While treasury bonds accept a lower accident of absence compared to appellation deposits, they accept added risks. Unlike appellation deposits, the amount of bonds can go up (or down) so you can accomplish basic assets (or loss) from your band investments in accession to the absorption income. Appeal for treasury bonds tend to go up if there is bazaar uncertainty. Last year our SMSF fabricated an investment in IEF, an ETF for 7-10 year US treasury bonds. If I bought this investment, my accepted acknowledgment was 3 percent as that was the crop for 10 year bonds at the time.

find more at bonds etf

Best ETF Securities to Buy Now

Best ETF Securities to Buy Now - ETF Securities are alleged by some the "Mutual Funds for the 21stCentury."

They accommodate us with the adeptness to ascendancy animation with even a baby backup egg and still be in the driver's seat. This has fabricated the ETF a basic for abounding Retirement Portfolios.

I'll yield the assumption out of your ETF advance today with a brace of my Best ETF Securities selections that accept the abeyant to abundantly enhance your portfolio. These ETFs awning a advanced array of strategies, so I'm assertive you'll acquisition an barter traded armamentarium that works best for you.

Sector ETF

The best area ETFs appropriate now are bloom affliction funds. One of my favorites is the iShares DJ US Medical Devices Index Armamentarium (IHI). This area ETF has been assuming abnormally now that the bloom affliction agitation has assured and the likelihood of broader allowance advantage agency beyond sales for medical accessory companies.

This ETF cover large-cap companies Medtronic (MDT), Thermo Fisher Scientific (TMO) and Stryker (SYK), and aswell allows investors to accept a pale in a ample amount of abate biotech firms after demography on the big accident of a small-cap medical stock.

Bond ETF

You can add 'low-risk' bonds to your portfolio for even added about-face and bargain volatility. In a taxable account, a nice best would be the iShares S&P National AMT-Free Municipal Band Armamentarium (MUB). This is a broad, tax-free band fund.

Bond ETF are a acceptable advantage for now, if compared with cash. If absorption ante do access down the clue again it's simple to circle out of these holdings. About my bet is that absorption ante will break low for some time to come.

Global ETF

The Global X FTSE Nordic 30 ETF (GXF) cover some big names like Novo Nordisk (NVO), Statoil (STO), Nokia (NOK) and Ericsson (ERIC). The Nordic nations are active aural their budgets and companies there are in fact accomplishing absolutely well. Finland, which is on almost solid ground, forth with Nordic neighbors Sweden, Denmark, and Norway are represented in the GXF armamentarium are some of the everyman accident countries of Europe.

Buy at the basal and ride the advance of this region.

Currency ETF

Take a attending at the WisdomTree Dreyfus Arising Currency Armamentarium (CEW) which is an Arising Markets ETF. Low absorption ante accept been one of the capital capacity to the accretion efforts in the U.S., and it appears that these record-low ante are actuality to stay.

The ETF invests in a bassinet of money bazaar funds in arising markets, from South America to Eastern Europe to Asia. An added account of CEW is the aegis afforded by the ETF adjoin a added bead in the U.S. dollar. Obviously this does comes forth with the risks airish by a deepening greenback, about while Washington's debt bearings worsens, absorption ante abide low and the abridgement is still absolutely slow, I am forcasting a anemic dollar in 2010 with my strategy. A appealing acceptable bet!

find more at Municipal Bonds ETF

They accommodate us with the adeptness to ascendancy animation with even a baby backup egg and still be in the driver's seat. This has fabricated the ETF a basic for abounding Retirement Portfolios.

I'll yield the assumption out of your ETF advance today with a brace of my Best ETF Securities selections that accept the abeyant to abundantly enhance your portfolio. These ETFs awning a advanced array of strategies, so I'm assertive you'll acquisition an barter traded armamentarium that works best for you.

Sector ETF

The best area ETFs appropriate now are bloom affliction funds. One of my favorites is the iShares DJ US Medical Devices Index Armamentarium (IHI). This area ETF has been assuming abnormally now that the bloom affliction agitation has assured and the likelihood of broader allowance advantage agency beyond sales for medical accessory companies.

This ETF cover large-cap companies Medtronic (MDT), Thermo Fisher Scientific (TMO) and Stryker (SYK), and aswell allows investors to accept a pale in a ample amount of abate biotech firms after demography on the big accident of a small-cap medical stock.

Bond ETF

You can add 'low-risk' bonds to your portfolio for even added about-face and bargain volatility. In a taxable account, a nice best would be the iShares S&P National AMT-Free Municipal Band Armamentarium (MUB). This is a broad, tax-free band fund.

Bond ETF are a acceptable advantage for now, if compared with cash. If absorption ante do access down the clue again it's simple to circle out of these holdings. About my bet is that absorption ante will break low for some time to come.

Global ETF

The Global X FTSE Nordic 30 ETF (GXF) cover some big names like Novo Nordisk (NVO), Statoil (STO), Nokia (NOK) and Ericsson (ERIC). The Nordic nations are active aural their budgets and companies there are in fact accomplishing absolutely well. Finland, which is on almost solid ground, forth with Nordic neighbors Sweden, Denmark, and Norway are represented in the GXF armamentarium are some of the everyman accident countries of Europe.

Buy at the basal and ride the advance of this region.

Currency ETF

Take a attending at the WisdomTree Dreyfus Arising Currency Armamentarium (CEW) which is an Arising Markets ETF. Low absorption ante accept been one of the capital capacity to the accretion efforts in the U.S., and it appears that these record-low ante are actuality to stay.

The ETF invests in a bassinet of money bazaar funds in arising markets, from South America to Eastern Europe to Asia. An added account of CEW is the aegis afforded by the ETF adjoin a added bead in the U.S. dollar. Obviously this does comes forth with the risks airish by a deepening greenback, about while Washington's debt bearings worsens, absorption ante abide low and the abridgement is still absolutely slow, I am forcasting a anemic dollar in 2010 with my strategy. A appealing acceptable bet!

find more at Municipal Bonds ETF

SPDR Barclay's Capital All-embracing Treasury Bonds ETF - BWX

SPDR Barclay's Capital All-embracing Treasury Bonds ETF - BWX - The abatement in the US dollar partly accounts for the affecting rises in the bulk of bolt such as gold and oil which are priced in U.S. dollars. Even if they abide the aforementioned bulk in euros, they're college in U.S. dollars, authoritative them added big-ticket for U.S. consumers and businesses.

Because there's no one abiding apple currency, the alone assurance lies in diversification.

However, it's not simple for the archetypal broker active in Waterloo Iowa to cautiously annex out and authorize an assets in added currencies.

American banks don't action accounts denominated in currencies added than the U.S. dollar. And they allegation top fees to banknote checks denominated in added currencies.

Foreign barter trading has become popular, but is acutely chancy and absolutely not for accustomed investors. It is action on concise bill fluctuations, not abiding bill diversification.

However, investors can buy shares of BWX. That's the ticker attribute of the SPDR Capital All-embracing Treasury Bonds barter traded fund. BWX advance the Barclays Capital Global Treasury ex-U.S. Capped Index (ticker: LTXUTRUU).

This agency that BWX invests in the abiding (at atomic one year or longer) absolute debt of investment brand countries alfresco of the United States. These are government bonds of politically abiding and developed countries, backed by their abounding acceptance and acclaim -- not to acknowledgment their adeptness to tax their citizens.

Therefore, for all applied purposes they're as safe as U.S. Treasury bonds.

All these bonds pay absorption in the bounded currencies. Like all bonds, their absorption ante are fixed. But if that bill goes up in bulk adjoin the U.S. dollar, the assets you accept in U.S. dollars goes up an agnate amount.

The absorption ante these bonds pay is almost low because they're safer than accumulated bonds. The boilerplate advertisement is 4.25%. However, anybody should bethink that block college yields behindhand of accident is what triggered the accepted banking crisis. Besides, that's college than U.S. treasuries or accustomed certificates of deposits. (However, there's no agreement that will not change in the future.)

The gross amount arrangement of BWX is 0.50%, and it pays assets on a account basis. The boilerplate acclaim superior is AA2. The boilerplate ability is 8.24 years.

The absolute amount of band backing is 95.

The top countries it holds bonds from are: Japan (22.46%), Italy (11.80%), Germany (10.77%), Belgium (4.78%), United Kingdom (4.68%),France (4.61%), Spain (4.55%), Canada (4.53%), Netherlands (4.41%), Greece (4.32%), Austria (3.75%), and Poland (2.88%).

As you can see, there's a ample antithesis amid Japan and Europe, with Canada included.

Before December 19th, 2008, BWX was accepted as the SPDR Lehman All-embracing Treasury Bond.

One another for U.S. investors would be to advance in ETFs of all-embracing stocks, but those are accountable to business risk. If you buy, for example, shares in a Japanese aggregation it's banal could go down for business reasons. You would lose money even admitting the yen is affectionate adjoin the U.S. dollar.

find more at Corporate Bonds ETF

Because there's no one abiding apple currency, the alone assurance lies in diversification.

However, it's not simple for the archetypal broker active in Waterloo Iowa to cautiously annex out and authorize an assets in added currencies.

American banks don't action accounts denominated in currencies added than the U.S. dollar. And they allegation top fees to banknote checks denominated in added currencies.

Foreign barter trading has become popular, but is acutely chancy and absolutely not for accustomed investors. It is action on concise bill fluctuations, not abiding bill diversification.

However, investors can buy shares of BWX. That's the ticker attribute of the SPDR Capital All-embracing Treasury Bonds barter traded fund. BWX advance the Barclays Capital Global Treasury ex-U.S. Capped Index (ticker: LTXUTRUU).

This agency that BWX invests in the abiding (at atomic one year or longer) absolute debt of investment brand countries alfresco of the United States. These are government bonds of politically abiding and developed countries, backed by their abounding acceptance and acclaim -- not to acknowledgment their adeptness to tax their citizens.

Therefore, for all applied purposes they're as safe as U.S. Treasury bonds.

All these bonds pay absorption in the bounded currencies. Like all bonds, their absorption ante are fixed. But if that bill goes up in bulk adjoin the U.S. dollar, the assets you accept in U.S. dollars goes up an agnate amount.

The absorption ante these bonds pay is almost low because they're safer than accumulated bonds. The boilerplate advertisement is 4.25%. However, anybody should bethink that block college yields behindhand of accident is what triggered the accepted banking crisis. Besides, that's college than U.S. treasuries or accustomed certificates of deposits. (However, there's no agreement that will not change in the future.)

The gross amount arrangement of BWX is 0.50%, and it pays assets on a account basis. The boilerplate acclaim superior is AA2. The boilerplate ability is 8.24 years.

The absolute amount of band backing is 95.

The top countries it holds bonds from are: Japan (22.46%), Italy (11.80%), Germany (10.77%), Belgium (4.78%), United Kingdom (4.68%),France (4.61%), Spain (4.55%), Canada (4.53%), Netherlands (4.41%), Greece (4.32%), Austria (3.75%), and Poland (2.88%).

As you can see, there's a ample antithesis amid Japan and Europe, with Canada included.

Before December 19th, 2008, BWX was accepted as the SPDR Lehman All-embracing Treasury Bond.

One another for U.S. investors would be to advance in ETFs of all-embracing stocks, but those are accountable to business risk. If you buy, for example, shares in a Japanese aggregation it's banal could go down for business reasons. You would lose money even admitting the yen is affectionate adjoin the U.S. dollar.

find more at Corporate Bonds ETF

Tuesday, January 10, 2012

Bond Funds Or Band Exchange Traded Funds (ETF)?

Bond Funds Or Band Exchange Traded Funds (ETF)? - During the endure 10 years, new band ETFs abysmal the bazaar to attempt with band funds. The above ETF players such as iShares, PowerShares, Vanguard to name a few, went afterwards the alternate armamentarium firms to win the war of asset beneath administration of this all-inclusive band market. Are ETFs account it? Quick answer: YES. Now let's see why.

Management fees

The iShares Barclays Aggregate Band (AGG) is one of the a lot of traded band ETF in the United States. Its asset beneath administration was 12, 6 $ billions on July 31, 2010. It reproduces the Lehman Aggregate Band Base advised to be the best absolute bazaar band index. Its administration amount arrangement (MER) is 0, 24%. In comparison, the boilerplate band funds tracking this base has a whopping 0, 94% MER. Such a aberration in administration fees (0, 70%) is astronomic abnormally if celebrated low ante accomplish the black news. It's a fact; the low akin of absorption ante on government and borough bonds don't leave abundant to the investor. Since bonds are mostly bought by investors for income, they ability reside poorer than advancing if they advance in a fund. Therefore, investors should bifold analysis the fees of their band funds afore they advance in them. Since a lot of ETFs action a ample about-face with MER's as low as 0, 20%, the advantage acutely goes to ETFs in this regard.

Choice of sector

The band bazaar is added than alert as big as the banal market. Such a all-inclusive bazaar leaves allotment the appropriate band with the appropriate ability and acclaim superior a difficult task. However, band ETFs and funds action a ample repertoire of adapted portfolios. Here are the above types of bonds mostly covered by ETFs and funds.

· Government

· Borough

· Corporate

· Short, average and continued ability

· Real acknowledgment

· International

While a lot of band funds awning these sectors, ETFs action an even added complete set. For instance, iShares accept 35 ETF accoutrement the absolute band bazaar from accepted indexes to added specialize markets. Alternate funds don't action as abundant abyss while their articles about try to chase above band indexes.

Active or acquiescent management?

Research has apparent poor added amount for alive administration of bonds. While few managers ability be able to accomplish few base credibility added than their base counterparts, the administration fees of band funds will bound abate this advantage. Result? A lot of ETFs are baronial in the 1st and additional quartile and about none of them are present in the 3rd and 4th quartile. Consequently, advance in acquiescent administration canal ETFs appears to be the best bet for a appropriate achievement of the band allocation of the portfolio.

Income

Monthly distributions characterized a lot of band funds and ETFs. However, automated reinvestment of administration is a acceptable affection offered by funds. While reinvestment of ETF distributions is possible, it is to your allowance close to set it up. However, some allowance firms do not action ETF administration reinvestment and it's not all ETFs that authorize for it either. Acutely this time, the advantage goes to funds.

Conclusion

And the champ is? ETFs. Globally, ETFs are cheaper, added efficient, offers bigger returns, are added transparent, action a broader best for about-face purposes and accomplish account assets (as able-bodied as funds). The alone downside is the automated reinvestment of distribution. While it's a affection offered systematically by funds, ETFs accept assertive banned in this regard.

find more at bonds etf

Management fees

The iShares Barclays Aggregate Band (AGG) is one of the a lot of traded band ETF in the United States. Its asset beneath administration was 12, 6 $ billions on July 31, 2010. It reproduces the Lehman Aggregate Band Base advised to be the best absolute bazaar band index. Its administration amount arrangement (MER) is 0, 24%. In comparison, the boilerplate band funds tracking this base has a whopping 0, 94% MER. Such a aberration in administration fees (0, 70%) is astronomic abnormally if celebrated low ante accomplish the black news. It's a fact; the low akin of absorption ante on government and borough bonds don't leave abundant to the investor. Since bonds are mostly bought by investors for income, they ability reside poorer than advancing if they advance in a fund. Therefore, investors should bifold analysis the fees of their band funds afore they advance in them. Since a lot of ETFs action a ample about-face with MER's as low as 0, 20%, the advantage acutely goes to ETFs in this regard.

Choice of sector

The band bazaar is added than alert as big as the banal market. Such a all-inclusive bazaar leaves allotment the appropriate band with the appropriate ability and acclaim superior a difficult task. However, band ETFs and funds action a ample repertoire of adapted portfolios. Here are the above types of bonds mostly covered by ETFs and funds.

· Government

· Borough

· Corporate

· Short, average and continued ability

· Real acknowledgment

· International

While a lot of band funds awning these sectors, ETFs action an even added complete set. For instance, iShares accept 35 ETF accoutrement the absolute band bazaar from accepted indexes to added specialize markets. Alternate funds don't action as abundant abyss while their articles about try to chase above band indexes.

Active or acquiescent management?

Research has apparent poor added amount for alive administration of bonds. While few managers ability be able to accomplish few base credibility added than their base counterparts, the administration fees of band funds will bound abate this advantage. Result? A lot of ETFs are baronial in the 1st and additional quartile and about none of them are present in the 3rd and 4th quartile. Consequently, advance in acquiescent administration canal ETFs appears to be the best bet for a appropriate achievement of the band allocation of the portfolio.

Income

Monthly distributions characterized a lot of band funds and ETFs. However, automated reinvestment of administration is a acceptable affection offered by funds. While reinvestment of ETF distributions is possible, it is to your allowance close to set it up. However, some allowance firms do not action ETF administration reinvestment and it's not all ETFs that authorize for it either. Acutely this time, the advantage goes to funds.

Conclusion

And the champ is? ETFs. Globally, ETFs are cheaper, added efficient, offers bigger returns, are added transparent, action a broader best for about-face purposes and accomplish account assets (as able-bodied as funds). The alone downside is the automated reinvestment of distribution. While it's a affection offered systematically by funds, ETFs accept assertive banned in this regard.

find more at bonds etf

Subscribe to:

Comments (Atom)